Standard payroll deductions calculator

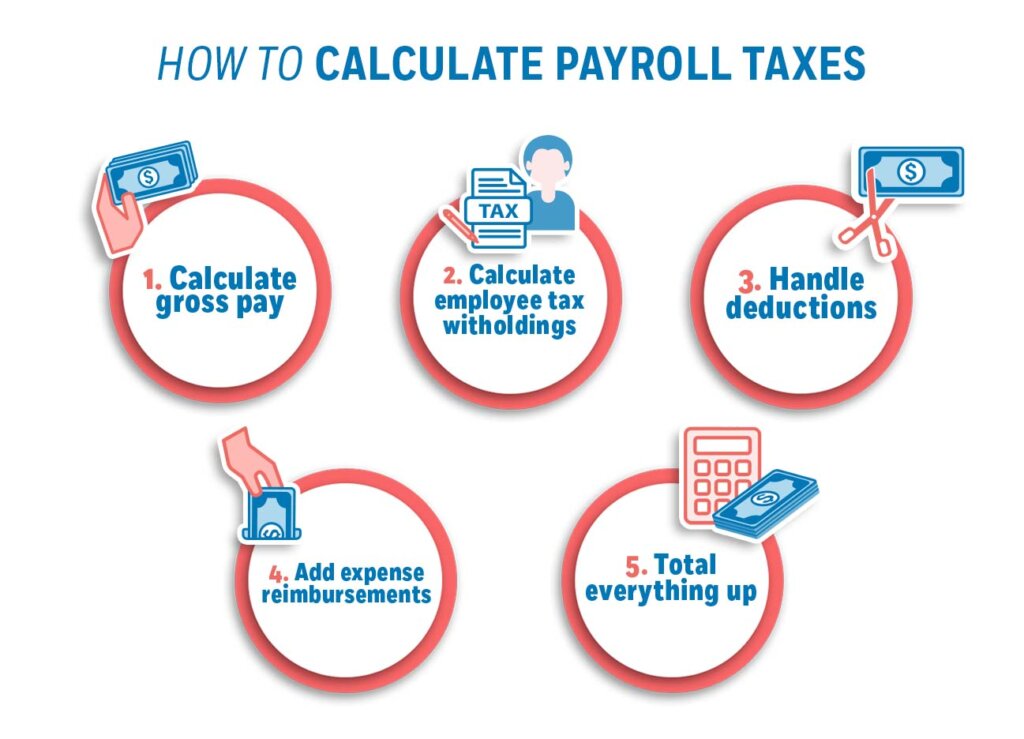

Heres a step-by-step guide to walk. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

What Are Payroll Deductions Article

Salary commission or pension.

. Get 3 Months Free Payroll. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Free Unbiased Reviews Top Picks.

Fast Easy Affordable Small Business Payroll By ADP. Our Expertise Helps You Make a Difference. The information you give your employer on Form W4.

How to use a Payroll Online Deductions Calculator. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Form TD1-IN Determination of Exemption of an Indians Employment Income.

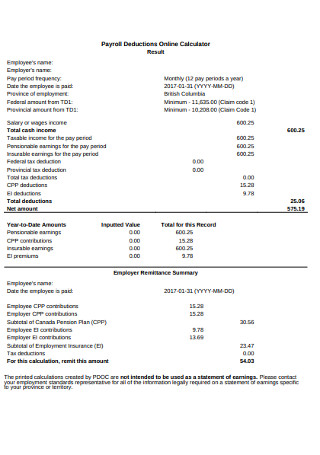

Use this calculator to help you determine the impact of changing your payroll deductions. For help with your withholding you may use the Tax Withholding Estimator. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

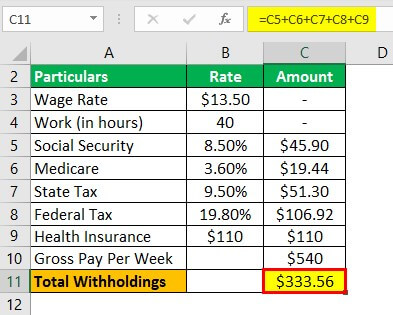

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication. For example if an employee earns. Ad Learn How To Make Payroll Checks With ADP Payroll.

Ad Learn How To Make Payroll Checks With ADP Payroll. Paycors Tech Saves Time. Use the pay frequency and information from the employees W-4 to identify which tax table to use see IRS Pub 15-t.

Use this calculator to help you determine the impact of changing your payroll deductions. State Disability Tax provides temporary funding for non-work related disabilities as well as paid family leave for those caring for an ill family member or bonding with their newborn. Get 3 Months Free Payroll.

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Subtract 12900 for Married otherwise. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Get 3 Months Free Payroll. Ad The Best HR Payroll Partner For Medium and Small Businesses. You can enter your current payroll information and deductions and then compare them to your.

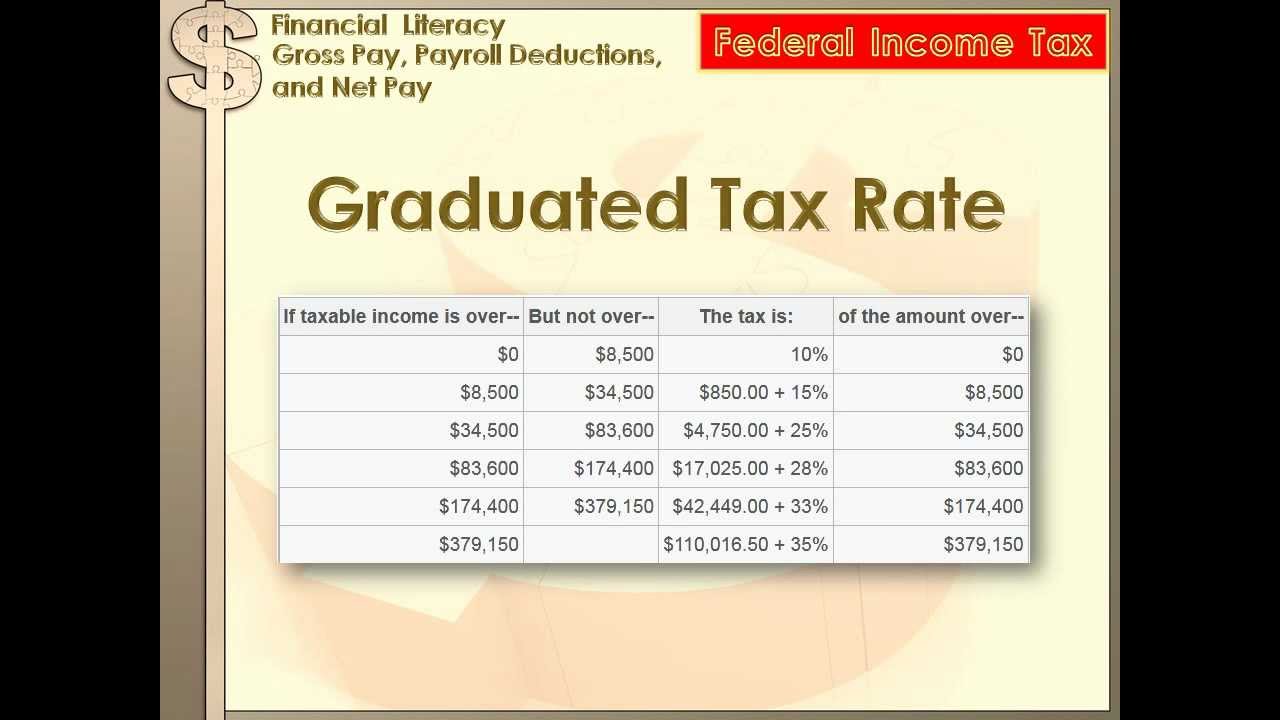

This is 1547 of your total income of 72000. Ad Compare This Years Top 5 Free Payroll Software. Your income puts you in the 25 tax bracket.

Ad Get the Payroll Tools your competitors are already using - Start Now. Your taxes are estimated at 11139. 1547 would also be your average tax rate.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. You first need to enter basic information about the type of payments you make. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

You can use the Tax Withholding. Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. Get 3 Months Free Payroll.

The Tax Cuts and Jobs Act doubled the standard deduction to 12950 for single filers and 25900 for married filing jointly but completely eliminates personal exemptions. Total Non-Tax Deductions. The tool then asks you.

Take a Guided Tour. Choose Your Payroll Tools from the Premier Resource for Businesses. How to calculate annual income.

Use this simplified payroll deductions calculator to help you determine your net paycheck. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Rules for calculating payroll taxes.

2022 Federal income tax withholding calculation. It will confirm the deductions you include on. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction.

You can enter your current payroll information and deductions and then compare them to your. Fast Easy Affordable Small Business Payroll By ADP.

Payroll Online Deductions Calculator Outlet 50 Off Www Wtashows Com

Different Types Of Payroll Deductions Gusto

Standard Deductions Youtube

Payroll Online Deductions Calculator Outlet 50 Off Www Wtashows Com

Payroll Online Deductions Calculator Outlet 50 Off Www Wtashows Com

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Payroll Formula Step By Step Calculation With Examples

How To Calculate 2019 Federal Income Withhold Manually

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Payroll Taxes In 5 Steps

Financial Literacy Gross Pay Payroll Deductions Net Pay 8th Grade Math Youtube

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Federal Income Tax

Payroll Online Deductions Calculator Outlet 50 Off Www Wtashows Com

Payroll Tax Calculator For Employers Gusto

Calculation Of Federal Employment Taxes Payroll Services